Break-Even Analysis: When Does Offshore Staffing Make Financial Sense for Your MSP

Every MSP owner has run the numbers. You know domestic helpdesk technicians cost $45,000-65,000 annually (fully loaded), that turnover averages 40% and costs $12,000 per replacement, and that you're operating on 20-30% net margins while labor consumes 35-55% of your revenue. You've heard offshore staffing can save 60-70%, but the real question isn't whether it saves money—it's when those savings materialize and how quickly you recoup the implementation investment.

This break-even analysis cuts through the marketing claims to provide MSP-specific calculations based on real operational data. We'll examine the true fully-loaded costs of domestic versus offshore technicians, calculate break-even points for different MSP scenarios, identify hidden costs that many MSPs overlook, and provide decision frameworks based on your current ticket volume, team size, and margins.

The short answer for most MSPs: if you're handling 800+ tickets monthly with at least one full-time domestic technician, offshore staffing reaches break-even in 6-8 weeks and delivers $40,000-60,000 annual savings per position. But the full picture is more nuanced, and understanding your specific break-even point is critical to making informed decisions.

As our comprehensive analysis of MSP staffing challenges details, 52% of MSPs report they cannot find technicians at rates they can afford. Break-even analysis helps you determine whether offshore staffing solves both your capacity and economic challenges.

Understanding the True Cost: Domestic vs. Offshore

Most MSPs underestimate the true fully-loaded cost of domestic technicians because they focus only on salary rather than total cost of employment. Let's break down reality.

The Domestic Technician: Full Cost Breakdown

For a Level 1 helpdesk technician in a major metro (Toronto, Vancouver, New York, Los Angeles, Sydney, Melbourne):

Base Salary: $45,000-55,000 (entry-level, major markets)

Payroll Taxes and Benefits:

Employer payroll taxes (7.65% US, 10-12% Canada, 9.5% Australia): $4,000-6,000

Health insurance: $6,000-12,000 annually

Retirement contributions (if offered): $1,800-2,750

PTO/sick time (15-20 days): $2,600-4,200 (opportunity cost)

Workers' compensation insurance: $500-1,200

Overhead Allocation:

Workstation, equipment, software licenses: $2,000-3,500 annually (amortized)

Office space (if not fully remote): $3,600-6,000 ($300-500/month allocated)

Training and professional development: $1,500-3,000

Recruiting costs (amortized over average tenure of 18-24 months): $6,000-8,000 annually

Total Fully-Loaded Annual Cost: $72,000-101,650

Average: ~$87,000 per domestic Level 1 technician

This is before accounting for turnover costs. With 40% annual turnover typical in MSP helpdesk roles, you're likely replacing this position every 2-3 years at an average cost of $12,000 per replacement (recruiting, lost productivity, training time).

The Offshore Technician: Full Cost Breakdown

For a Philippines-based Level 1 helpdesk technician through a staffing provider:

Base Compensation: $15,000-22,000 USD annually (all-in through provider)

What's Included in That Price:

Technician salary (competitive in Philippine market)

Philippine employer taxes (SSS, PhilHealth, Pag-IBIG)

Mandatory benefits (13th month pay, leave benefits)

Office space, workstation, backup power, redundant internet

HR administration and payroll management

Recruitment and replacement guarantee

Additional Costs You Control:

Software licenses (PSA/RMM access): $1,200-2,400 annually

Initial onboarding time investment: ~40-60 hours of management time

Ongoing management: ~2-4 hours weekly (same as domestic remote staff)

Total Fully-Loaded Annual Cost: $16,200-24,400

Average: ~$20,300 per offshore Level 1 technician

Cost Differential: $87,000 - $20,300 = $66,700 annual savings per position

Savings Percentage: 76.7% compared to domestic equivalent

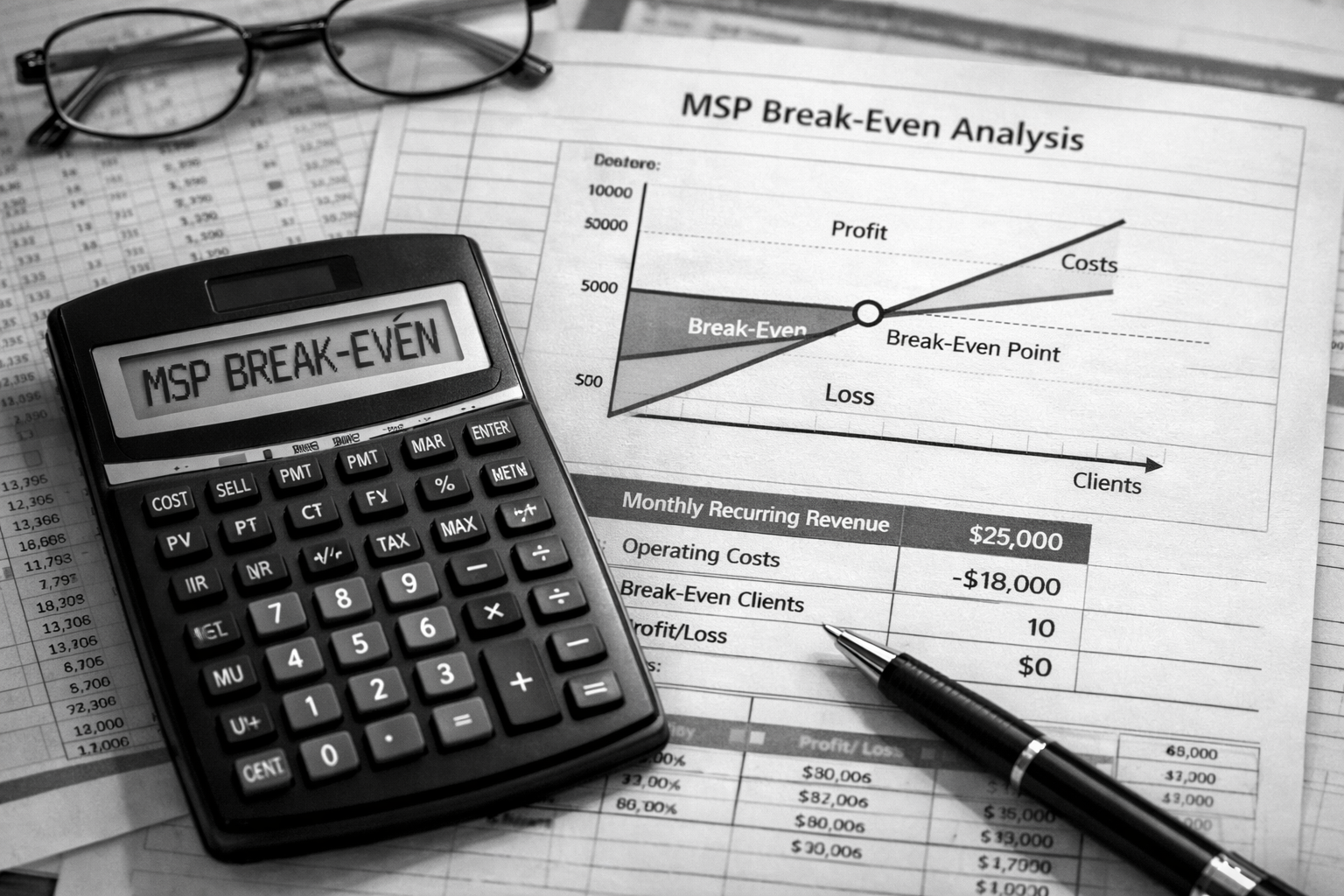

Break-Even Scenarios: When Does It Make Sense?

Let's examine break-even timelines for different MSP situations, accounting for implementation costs and transition periods.

Scenario 1: Single Technician Replacement

Starting Point:

One domestic helpdesk technician: $87,000 annual cost

Handling 80-120 tickets monthly

Position open or currently filled

Offshore Implementation:

One Philippines-based technician: $20,300 annual cost

Initial onboarding investment: $3,000-5,000 (management time, training, process documentation)

Transition period: 3-4 weeks to full productivity

Financial Analysis:

Monthly savings: ($87,000 - $20,300) / 12 = $5,558 per month

Implementation investment: $4,000 (average)

Break-even point: $4,000 / $5,558 = 0.72 months = ~3 weeks

Annual net savings (after implementation): $66,700 - $4,000 = $62,700 in year one

Decision criteria: If you currently have a domestic technician handling routine tickets OR have an unfilled position open for 2+ months, offshore implementation makes immediate financial sense. Break-even occurs within 1 month.

Scenario 2: Hiring for Growth (Adding Capacity)

Starting Point:

Need additional capacity for growth

Alternative is hiring domestic technician at $87,000

Expected ticket volume increase: 100+ tickets monthly

Offshore Implementation:

One Philippines-based technician: $20,300 annual cost

Onboarding investment: $4,000

Can deploy in 2-3 weeks vs. 60-90 days for domestic hire

Financial Analysis:

Cost avoidance: $87,000 - $20,300 = $66,700 annually

Time to revenue: Offshore team operational 6-8 weeks faster than domestic hire

Opportunity cost of delay: If new clients represent $8,000-12,000 MRR but you can't onboard them due to capacity constraints, every month of delay costs $8,000-12,000

Break-even point: Immediate—you're avoiding a larger expense rather than replacing existing cost

Annual benefit: $66,700 in direct savings + faster time to revenue = $75,000-100,000 total value

Decision criteria: When you need capacity to take on new business, offshore makes sense at any ticket volume because you're comparing against the alternative of not having the capacity at all.

Scenario 3: Team Scaling (3-5 Technicians)

Starting Point:

Growing MSP with 2,500-4,000 tickets monthly

Currently have 2-3 domestic technicians

Need to add 2-3 more but budget is constrained

Offshore Implementation:

3 Philippines-based technicians: $60,900 total annual cost

Onboarding investment: $10,000-12,000 (team setup, documentation, management systems)

Provides same capacity as 3 domestic hires at $261,000

Financial Analysis:

Annual savings: $261,000 - $60,900 = $200,100

Monthly savings: $16,675

Implementation investment: $11,000 (average)

Break-even point: $11,000 / $16,675 = 0.66 months = ~2.5 weeks

Annual net savings: $200,100 - $11,000 = $189,100 in year one

Impact on margins: If annual revenue is $2M with 25% net margin ($500K profit), adding $189K to the bottom line increases net margin to 34.5%—a transformational improvement.

Decision criteria: MSPs handling 2,500+ tickets monthly experience dramatic financial and operational benefits from team implementation. Break-even occurs in under 3 weeks, and margin improvements are substantial.

The Hidden Costs Most MSPs Overlook

A complete break-even analysis must account for factors beyond simple salary comparison.

| Cost Factor | Domestic Impact | Offshore Impact |

|---|---|---|

| Turnover & Replacement | $12,000 every 2-3 years (40% turnover) | $3,000-4,000 every 4-5 years (10-15% turnover) |

| Unfilled Position Opportunity Cost | 60-90 days average time-to-hire, $15,000-25,000 lost revenue | 14-21 days deployment, $5,000-8,000 opportunity cost |

| Overtime / On-Call Burden | $8,000-15,000 annually (time-and-a-half rates) | $2,000-4,000 (standard rates, no night premium) |

| Training Time to Productivity | 3-6 months to full productivity | 2-4 months (similar learning curve) |

| Salary Inflation | 5-8% annual increases in competitive markets | 2-4% annual increases |

The Turnover Cost Multiplier

Domestic MSP technicians average 18-24 month tenure. At $12,000 per replacement, this adds an effective $6,000-8,000 annually to the true cost of domestic employment. Over 5 years, you'll likely replace the position 2-3 times at $24,000-36,000 total additional cost.

Philippines-based technicians average 3-5 year tenure, with replacement costs of $3,000-4,000. Over the same 5 years, you'll likely replace the position once (if at all) at $3,000-4,000 total cost.

5-Year Turnover Cost Differential: $21,000-32,000 additional savings for offshore

The Opportunity Cost of Unfilled Positions

When a domestic position sits unfilled for 75 days (average), and that technician would have handled 300 tickets generating $8,000-12,000 in revenue, you've lost substantial opportunity. If you're turning away new business due to capacity constraints, multiply that impact.

Offshore deployment in 14-21 days reduces this window by 55-60 days, recovering 2+ months of productive capacity worth $16,000-24,000.

The Salary Inflation Factor

In competitive tech markets, annual salary increases of 5-8% are standard. For a position starting at $55,000, this compounds to $72,000-82,000 by year 5—a $17,000-27,000 increase.

Philippines-based technicians see 2-4% annual increases, compounding to $16,500-18,600 by year 5—a $1,500-3,600 increase.

5-Year Salary Inflation Differential: ~$15,000-23,000 additional savings for offshore

Real MSP Scenarios: Does Your Situation Warrant Offshore?

Let's examine specific MSP profiles to determine when offshore makes sense.

Micro MSP (10-30 Clients, $250K-500K Revenue)

Current State:

Owner + 1 part-time technician

200-400 tickets monthly

15-20% net margin

Owner handling many tickets personally

Offshore Analysis:

Doesn't Make Sense If:

Ticket volume under 300/month

Owner prefers hands-on technical work

Client base highly localized requiring frequent on-site visits

Makes Sense If:

Owner wants to focus on sales/client relationships

Ticket volume consistently exceeds 400/month

Ready to document processes for delegation

Growth strategy requires freeing owner time

Financial Impact: One offshore technician ($20,300) handling 60-70% of routine tickets frees 15-20 owner hours weekly. If owner's time is worth $100-150/hour, that's $78,000-156,000 annual value creation—far exceeding the offshore cost.

Break-even: Immediate if owner time is productively redeployed

Small MSP (30-80 Clients, $750K-1.5M Revenue)

Current State:

2-3 full-time domestic technicians

800-1,500 tickets monthly

20-25% net margin

Struggling to scale due to hiring challenges

Offshore Analysis:

Strong Case For Offshore:

Replace or supplement domestic team with 1-2 offshore technicians

Use offshore for Level 1/after-hours, keep senior domestic staff for complex work

Dramatic margin improvement: 60-70% cost savings on 1-2 positions = $40,000-100,000 annually

Financial Impact: Implementing 2 offshore technicians ($40,600 total) alongside 1 senior domestic technician ($95,000) costs $135,600 vs. 3 domestic technicians ($261,000). Annual savings: $125,400.

At $1.2M revenue with 22% margin ($264K profit), adding $125,400 to the bottom line increases net margin to 32.5%—a game-changing improvement.

Break-even: 3-4 weeks after onboarding

Mid-Market MSP (80-150 Clients, $2M-4M Revenue)

Current State:

5-8 domestic technicians

2,500-4,000 tickets monthly

25-30% net margin

Capacity constraints limiting growth

Offshore Analysis:

Optimal Structure:

3-5 offshore technicians handling Level 1, after-hours, routine work

3-4 domestic senior technicians for complex issues, client relationships, projects

Creates capacity for growth without proportional cost increase

Financial Impact: Replacing 4 domestic Level 1 positions ($348,000) with offshore team ($81,200) saves $266,800 annually.

At $3M revenue with 27% margin ($810K profit), adding $266,800 increases net margin to 35.9%.

More importantly, this frees domestic staff to focus on higher-value work—projects, vCIO services, strategic consulting—that commands premium pricing and improves both revenue and margins.

Break-even: 2-3 weeks after team onboarding

ROI in Year 1: 325% ($266,800 savings / $81,200 investment)

The Decision Framework: Should Your MSP Offshore?

Use this framework to determine if offshore staffing makes financial sense for your specific situation.

GREEN LIGHT: Offshore Makes Clear Financial Sense

Criteria:

Monthly ticket volume exceeds 800

Currently employ (or need to employ) 2+ helpdesk technicians

Net margins below 25% with labor costs above 40% of revenue

Experiencing 30%+ annual turnover in helpdesk roles

Turning away business due to capacity constraints

Unable to afford domestic wage demands in your market

Expected Outcome: Break-even in 3-8 weeks, annual savings of $40,000-70,000 per offshore position, margin improvement of 3-8 percentage points

Action: Implement offshore pilot with 1-2 technicians, scale based on results

YELLOW LIGHT: Offshore Makes Conditional Sense

Criteria:

Monthly ticket volume 400-800

Currently employ 1-2 technicians

Margins are acceptable (25-30%) but could be better

Moderate turnover (20-30% annually)

Considering growth but uncertain about timing

Some processes documented but not comprehensive

Expected Outcome: Break-even in 2-4 months, moderate savings of $25,000-45,000 annually, operational complexity during transition

Action: Focus first on process documentation and determining clear use case (after-hours coverage? specific client accounts? overflow only?), then pilot with single technician for 90 days

RED LIGHT: Offshore Probably Doesn't Make Sense Yet

Criteria:

Monthly ticket volume under 300

Owner-operator model with no current employees

Highly localized business requiring frequent on-site work

Minimal process documentation

Inconsistent ticket volume (wide month-to-month variance)

Strong preference for maintaining direct personal relationships with all clients

Expected Outcome: Implementation challenges exceed financial benefits, difficult to achieve economies of scale, management overhead disproportionate to savings

Action: Focus on growth, process documentation, and operational maturity first. Revisit offshore when ticket volume consistently exceeds 500/month.

Beyond the Spreadsheet: Non-Financial Factors

Break-even analysis is fundamentally financial, but MSPs should consider qualitative factors that impact long-term success.

Operational Resilience

Domestic-only staffing creates single points of failure. When your two technicians are both on vacation, sick, or (inevitably) searching for new jobs, you're vulnerable. Offshore teams create redundancy and resilience.

As our analysis of how MSPs deliver 24/7 support without burnout details, distributed teams enable sustainable operations that don't depend on any single person being available.

Financial Value: Avoiding even one client loss due to service disruption ($1,500-3,000 MRR) justifies offshore implementation

Competitive Positioning

If your competitors implement offshore teams and pass savings to clients through better pricing or reinvest in service improvements, you face competitive pressure. The question becomes: can you afford NOT to optimize costs when competitors are doing so?

Financial Value: Maintaining competitive pricing while improving margins creates sustainable long-term advantage

Growth Optionality

Offshore capacity creates the ability to say YES to opportunities you'd otherwise decline. When a 50-user prospect appears but you lack bandwidth, do you pass or do you hire (knowing 90-day lead time may lose the deal)?

Financial Value: Each declined opportunity represents $1,500-5,000 MRR lost = $18,000-60,000 annually

Team Satisfaction and Retention

Domestic technicians appreciate not being on-call every other week or drowning in Level 1 tickets. Offshore teams handling routine work and after-hours coverage improve quality of life for domestic staff.

As our overflow support analysis explains, this reduces domestic turnover—saving $12,000 per avoided replacement.

Financial Value: Reducing domestic turnover from 40% to 25% saves $6,000-9,000 annually per domestic position

Implementation Costs: The Honest Picture

Most offshore staffing ROI analyses ignore or minimize implementation costs. Here's the real investment required.

Initial Setup (One-Time Costs)

Process Documentation: 20-40 hours of management time to document standard procedures, create knowledge base articles, and establish workflows ($3,000-6,000 opportunity cost)

Training Materials: Creating client-specific guides, escalation procedures, and training documentation ($1,000-2,000)

Technical Setup: Provisioning PSA/RMM access, establishing communication channels, setting up security protocols ($500-1,000)

Management Training: Learning how to effectively manage remote teams across time zones ($500-1,000)

Total One-Time Investment: $5,000-10,000

Ongoing Management Costs

Weekly Management Time: 2-4 hours per week for team coordination, quality review, and performance management ($4,000-8,000 annually at $40-50/hour management time)

Performance Monitoring: Time spent reviewing tickets, client feedback, and metrics (minimal if already doing this for domestic staff)

Cultural Integration: Occasional team calls, recognition, relationship building (1-2 hours monthly = $600-1,200 annually)

Total Ongoing Annual Cost: $5,000-10,000

Reality Check: You already spend similar time managing domestic staff. Offshore management is different (asynchronous communication, cultural awareness) but not inherently more time-consuming once established.

The Bottom Line: When the Math Makes Sense

For most MSPs handling 800+ tickets monthly with at least one full-time technician position (filled or unfilled), offshore staffing reaches break-even in 6-8 weeks and delivers $40,000-70,000 annual savings per offshore position.

The math becomes increasingly compelling as you scale. MSPs implementing 3-5 offshore technicians see annual savings of $150,000-250,000, transforming margins from 20-25% to 30-35%—the difference between struggling to stay competitive and having capital to invest in growth.

Even accounting for implementation costs, turnover risks, and management overhead, offshore staffing produces positive ROI for MSPs with sufficient volume to justify the operational investment.

As our comprehensive guide to offshore staffing ROI details, the most successful implementations don't just save money—they create strategic advantages through improved capacity, operational resilience, and competitive positioning.

The question isn't whether offshore staffing saves money. The data conclusively shows it does. The real question is whether your MSP has reached the inflection point where implementation makes sense—and for most MSPs handling 800+ tickets monthly, that answer is yes.

Ready to Run Your Own Numbers?

Konnect specializes in helping MSPs implement offshore teams that deliver measurable financial results while integrating seamlessly with existing operations.

What we provide:

Transparent cost analysis: We help you calculate your specific break-even point based on your current costs, ticket volume, and margins—no obligation, no sales pressure.

Right-sized implementation: Whether you need one technician or an entire team, we structure engagement models that match your actual requirements and budget.

Proven onboarding framework: Our implementation process minimizes time-to-productivity, reducing the break-even window and maximizing Year 1 savings.

Complete financial visibility: No hidden fees or surprise costs. You know exactly what you're paying monthly, making financial planning straightforward.

Performance guarantees: We stand behind the quality of our placements. If a team member isn't working out, we replace them at no additional cost.

Schedule a consultation to discuss your specific situation and run a custom break-even analysis.

📅 Schedule a meeting: https://meet.brevo.com/konnectph

✉️ Email us: hello@konnect.ph

Let's determine if—and when—offshore staffing makes financial sense for your MSP.

About the Author

Vilbert Fermin is the founder of Konnect, a remote staffing company connecting North American and Australian businesses with top Filipino talent. With deep expertise in IT support and remote team management, Vilbert helps MSPs access skilled technical professionals without the overhead of full-time domestic IT staff. His mission is to showcase Filipino excellence while helping businesses stay protected, productive, and competitive through strategic remote staffing.