Canada's Tech Skill Shortage: 2025 Market Scan

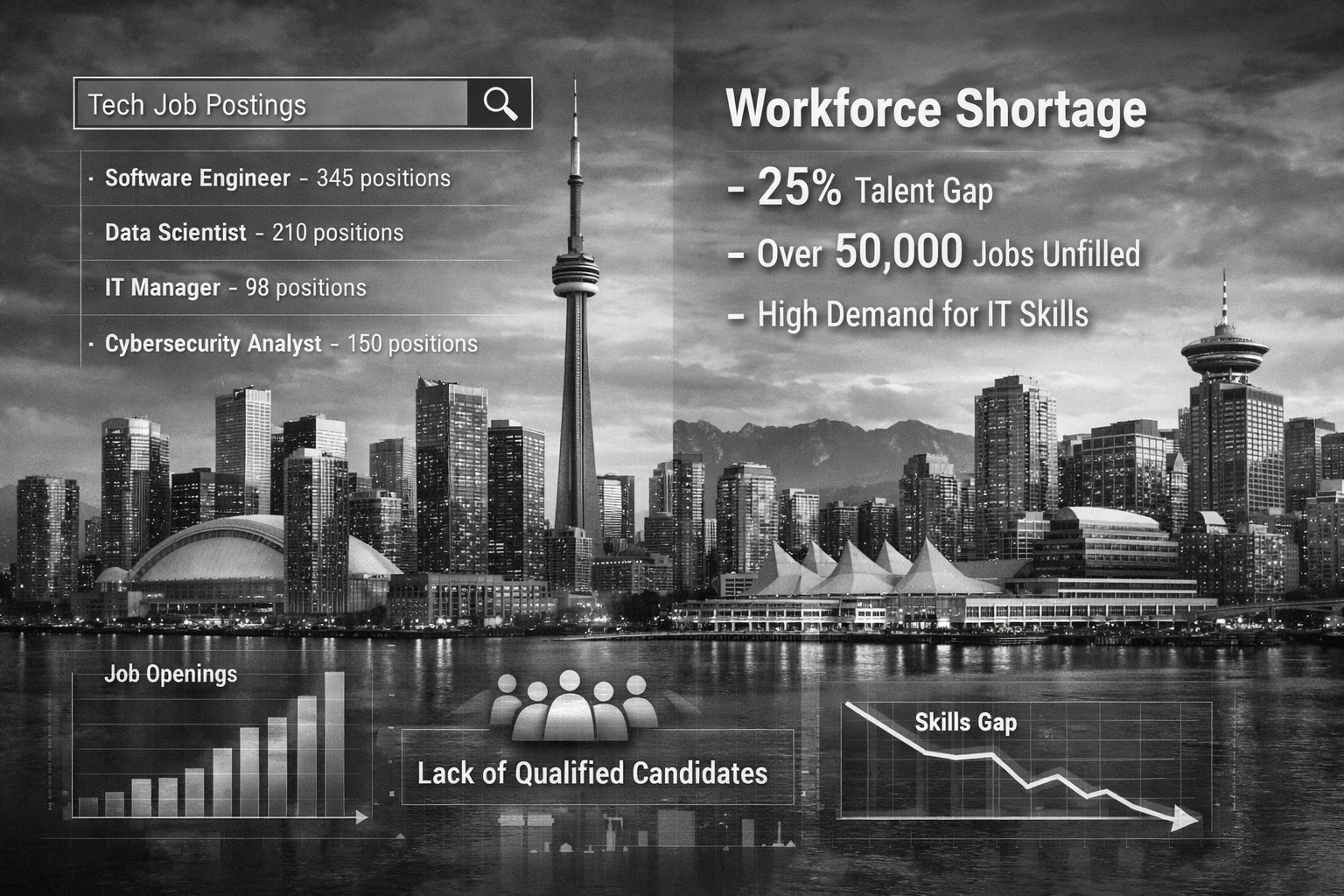

Canada's technology workforce has entered a new phase in 2025—one marked not by the exuberant growth of previous years, but by structural challenges that threaten to constrain the entire sector's potential. The numbers paint a stark picture: Canada needs an estimated 250,000 additional tech jobs filled by year's end, yet tech unemployment sits at just 3.3%, meaning virtually every qualified professional already has a job.

According to Robert Half's research, 88% of Canadian technology leaders say they face challenges finding skilled talent. This isn't a future problem or a temporary blip—it's a present crisis that's reshaping how Canadian businesses, particularly Managed Service Providers, approach staffing and operations.

The Conference Board of Canada projects that between 2023 and 2028, the Canadian economy will require an additional 305,000 tech workers. Yet the domestic talent pipeline simply cannot produce workers at this rate. Canadian universities and colleges graduate approximately 25,000-30,000 tech-related students annually—nowhere near the 60,000+ needed each year to meet demand and replace retiring workers.

For MSPs operating across Toronto, Vancouver, Montreal, and Calgary, this shortage has moved from inconvenience to existential challenge. As our comprehensive analysis of how Canadian MSPs are solving the technician shortage details, traditional hiring approaches have become economically unviable for businesses operating on 20-30% margins while competing with enterprise tech companies offering 30-40% higher compensation.

This market scan examines Canada's tech talent landscape in 2025, identifying where shortages are most acute, which skills command premium compensation, and—critically—how successful Canadian businesses are building technical capacity when traditional hiring falls short.

The Current State: By the Numbers

Understanding Canada's tech workforce requires looking beyond headline employment figures to the dynamics driving the shortage.

Employment and Demand Dynamics

The Canadian tech sector employed approximately 2.26 million workers in 2024—roughly 11% of all jobs in the country. Despite this substantial workforce, demand continues dramatically outpacing supply. According to recent industry analysis, one in six cybersecurity positions remains unfilled, representing over 25,000 open roles across Canada.

The Tech Talent North 2024 report found that 42% of IT professionals are actively looking for new jobs—a staggering figure that speaks to both opportunity and instability in the sector. When nearly half your workforce is job hunting, retention becomes as difficult as recruitment.

Tech unemployment at 3.3% represents essentially full employment in economic terms. This means Canadian businesses aren't competing for unemployed candidates—they're trying to poach employed workers from other companies, driving continuous wage inflation and instability.

The Compensation Arms Race

Canadian tech workers command significant premiums over non-tech roles, and those premiums are growing. According to Randstad's 2025 Salary Guide, certain specialized skills now command extraordinary premiums:

Machine learning expertise: 35% salary increase compared to baseline tech roles. Cybersecurity skills: 30% premium in competitive markets. Cloud architecture (AWS, Azure, GCP): 25-30% premium. DevOps and site reliability engineering: 20-25% premium.

The median tech salary in major Canadian markets now exceeds $85,000-95,000 CAD, with specialized roles in Toronto and Vancouver reaching $120,000-150,000 CAD. For MSPs operating on thin margins, these compensation levels create an impossible competitive dynamic against enterprise IT departments and well-funded tech companies.

Immigration's Changing Role

Historically, Canadian tech companies relied heavily on immigration to fill talent gaps. The challenge in 2025: immigration targets were reduced in late 2024, and the pathway for tech workers has become more complex. While Canada remains more immigration-friendly than many markets, policy uncertainty has made this a less reliable solution than in previous years.

Additionally, Canada now competes globally for immigrant tech talent. The UK, Australia, Germany, and other developed economies have all ramped up tech immigration programs, intensifying competition for qualified international workers.

Which Roles Face the Most Severe Shortages

Not all tech positions experience equal hiring challenges. Here's where Canada's shortage hits hardest.

AI and Machine Learning Engineers

The explosion of AI adoption has created unprecedented demand for professionals who understand machine learning, natural language processing, and generative AI implementation. According to Nash Squared's global research, AI skills are the fastest-growing demand in 16+ years of tech hiring data, with demand nearly doubling between 2024 and 2025.

Canadian companies are competing globally for limited AI talent, and most are losing that competition to US tech companies offering significantly higher compensation. A machine learning engineer in Toronto might earn $110,000-140,000 CAD; the same role in San Francisco commands $180,000-220,000 USD plus equity.

The challenge extends beyond salary. Canadian universities produce far fewer AI-specialized graduates than needed, and bootcamp programs haven't scaled sufficiently to fill the gap. Meanwhile, tech skills become outdated in just 2.5 years according to Harvard Business Review, meaning that even recent graduates often lack current AI competencies.

Cybersecurity Analysts and Engineers

With one in six cybersecurity positions unfilled nationally, this represents Canada's most acute tech talent shortage. The global cyber talent gap is estimated at close to 5 million professionals, and Canada represents a significant portion of that deficit.

The stakes are high. Cyberattacks on Canadian organizations increased 25% in 2024, with ransomware accounting for the majority of incidents. Yet 58% of Canadian organizations say cybersecurity staff shortages put them at significant risk. As our analysis of why 24/7 IT support is critical notes, the average cost of a data breach reached $4.88 million in 2024—a risk that understaffed organizations increasingly face.

Canadian businesses need cybersecurity professionals with both technical expertise and knowledge of Canadian compliance frameworks (PIPEDA, provincial privacy laws). This combination is extraordinarily rare and commands premium compensation.

Cloud Engineers and Architects

The accelerating shift to cloud-first infrastructure creates massive demand for cloud expertise. Canadian businesses need professionals who understand AWS, Azure, and Google Cloud, plus hybrid architectures, containerization, and cloud security—a skill combination that's rare and expensive.

According to Robert Half's research, cloud engineers command 25-30% salary premiums in competitive Canadian markets. Yet positions still sit unfilled for months because qualified candidates have multiple competing offers.

As our guide on managing remote IT teams explains, the shift to distributed development teams has made cloud expertise even more critical—organizations can't operate modern DevOps workflows without strong cloud architecture.

Data Scientists and Analytics Engineers

Data-driven decision-making has transformed from competitive advantage to business necessity. Canadian businesses need data scientists who can build predictive models, analytics engineers who can design data pipelines, and business intelligence professionals who can translate technical findings into actionable insights.

The problem? Universities produce data science graduates with strong statistical backgrounds but often weak programming skills, or computer science graduates with strong coding abilities but limited statistical knowledge. Finding the full combination—statistics, programming, business acumen, communication skills—is extremely difficult.

DevOps Engineers and Site Reliability Engineers

DevOps bridges the gap between development and operations, requiring both coding skills and infrastructure knowledge. Canadian tech companies increasingly adopt DevOps practices, yet finding qualified engineers remains extraordinarily difficult.

The challenge compounds in smaller markets. A DevOps engineer in Toronto has options; one in Halifax or Saskatoon may not exist at any price point.

The Helpdesk and NOC Technician Crisis

Here's the paradox that particularly affects Canadian MSPs: even entry-level positions are difficult to fill. Helpdesk technicians, NOC analysts, and Level 1-2 support specialists—roles that historically had healthy candidate pipelines—now sit unfilled for months across Toronto, Vancouver, Montreal, and Calgary.

Why? Several compounding factors drive this shortage. Experienced workers have moved up into specialized roles, leaving gaps at entry levels. Traditional helpdesk work is increasingly seen as a stepping stone rather than a career, leading to 40% annual turnover. Remote work means helpdesk technicians can work for companies anywhere, making local hiring nearly impossible in smaller markets. Finally, Canadian wages ($45,000-55,000 CAD for entry-level) make these positions expensive, yet many MSPs can't justify higher compensation for routine support work.

As our detailed analysis of Canadian MSP solutions explains, this creates an operational crisis: you can't deliver service without frontline support, but you also can't afford domestic wages for routine work that could be handled offshore at 60-70% cost savings.

Regional Variations: Canada's Tech Markets

The tech talent shortage manifests differently across Canadian regions. Understanding these variations helps businesses make informed staffing decisions.

Toronto and the Greater Toronto Area

Tech workforce: Approximately 450,000+ tech workers (largest in Canada)

Unemployment rate: ~2.8% (extremely tight)

Median tech salary: $90,000-110,000 CAD (higher for specialized roles)

Key challenge: Intense competition from financial services, enterprise tech, and startups. Even offering competitive salaries doesn't guarantee success when candidates have multiple offers. Toronto's high cost of living (average home price exceeding $1.1 million) means even six-figure salaries struggle to attract talent.

Common solution: Hybrid models combining selective local hiring for senior and client-facing roles with offshore teams handling operational support. As our analysis of overflow support needs details, Toronto MSPs increasingly use Philippines-based teams for Level 1-2 support and after-hours coverage.

Vancouver and British Columbia

Tech workforce: Approximately 140,000-160,000 tech workers

Unemployment rate: ~3.1%

Median tech salary: $85,000-100,000 CAD

Key challenge: Proximity to Seattle creates brain drain as Canadian talent seeks US salaries. Vancouver's exceptional cost of living (average home price over $1.2 million) makes retention difficult even with competitive Canadian compensation.

Common solution: Remote-first hiring from across BC and other provinces, combined with offshore teams for scalable capacity. Vancouver MSPs benefit from strong local talent for senior roles while using Philippines teams for frontline support.

Montreal and Quebec

Tech workforce: Approximately 230,000+ tech workers

Unemployment rate: ~3.4%

Median tech salary: $75,000-90,000 CAD (lower than Toronto/Vancouver)

Key challenge: Language requirements (French proficiency) limit the candidate pool. Bilingual tech professionals command premium compensation. Quebec's Law 25 (privacy law) creates additional compliance considerations for offshore arrangements.

Common solution: Quebec MSPs often use a tiered approach—bilingual staff for client-facing roles, offshore teams for backend operational work that doesn't require French language interaction.

Calgary and Alberta

Tech workforce: Approximately 100,000-120,000 tech workers

Unemployment rate: ~3.5%

Median tech salary: $80,000-95,000 CAD

Key challenge: Energy sector dominates tech hiring, creating competition for talent. Boom/bust cycles in oil and gas create volatility in the local tech market.

Common solution: Calgary MSPs increasingly use offshore staffing for consistency, as it provides capacity that doesn't fluctuate with energy sector cycles. Domestic staff focus on energy sector expertise while offshore teams handle general IT support.

Ottawa and National Capital Region

Tech workforce: Approximately 85,000-95,000 tech workers

Unemployment rate: ~3.2%

Median tech salary: $80,000-95,000 CAD

Key challenge: Government contracting requires security clearances and Canadian citizenship, limiting offshore options for some work. However, government procurement cycles create feast-or-famine dynamics.

Common solution: Hybrid approach with security-cleared Canadian staff for government work, offshore teams for commercial clients.

Why Traditional Hiring Solutions Fall Short

Canadian businesses facing talent shortages typically attempt several standard approaches. In 2025, most are producing diminishing returns.

The Salary Escalation Problem

Offering higher compensation helps you compete for available candidates, but it doesn't create candidates where none exist. When tech unemployment is 3.3%, you're not finding unemployed talent—you're trying to poach employed workers.

This sets off bidding wars. According to Randstad data, specialized skills now command 25-35% premiums over baseline tech roles. For MSPs operating on 20-30% margins, this compensation inflation makes it mathematically impossible to profitably deliver services while competing with enterprise IT departments.

The math is brutal: if your fully-loaded cost for a Level 2 technician rises from $65,000 CAD to $85,000 CAD (a 30% increase), you need to either raise client pricing by similar amounts (risking client loss) or accept margin compression that eliminates profitability.

Immigration Uncertainty Reduces Reliability

While Canadian immigration policy remains relatively favorable compared to other markets, recent changes have created uncertainty. Immigration targets were reduced in late 2024, and processing times have lengthened.

More critically, Canadian employers now compete globally for immigrant tech talent. The UK, Australia, Germany, and other developed economies all face similar shortages and have ramped up immigration programs targeting the same workers Canadian companies seek.

Training Programs Can't Scale Fast Enough

Upskilling and reskilling initiatives are valuable long-term investments, but they don't solve immediate staffing needs. It takes 6-12 months minimum to train someone from basic competence to productive contribution in most tech roles—often longer for specialized positions.

Given that tech skills have a half-life of 2.5 years, by the time your training program produces qualified workers, market demands may have shifted entirely. You're training people for yesterday's problems, not tomorrow's opportunities.

Additionally, Canadian universities and colleges can't scale programs overnight. Expanding enrollment requires years of planning, faculty hiring, and facility development. The gap between current graduate production (25,000-30,000 annually) and need (60,000+) won't close through education alone.

The High Turnover Problem

Even when Canadian businesses successfully hire, they face severe retention challenges. With 42% of IT professionals actively looking for new jobs, the average tenure for helpdesk and junior technicians is just 18-24 months.

This creates a vicious cycle for MSPs: invest heavily in recruiting and training, watch newly productive staff leave for higher-paying roles, repeat. The $12,000 average cost to replace a departed technician quickly becomes unsustainable when turnover hits 40% annually.

Solutions That Are Actually Working

While traditional hiring struggles, innovative Canadian businesses—particularly MSPs—are finding alternative approaches that solve talent shortages sustainably.

| Solution | Best For | Cost Savings | Time to Deploy |

|---|---|---|---|

| Offshore Staffing (Philippines) | Helpdesk, NOC, Level 1-2 support, after-hours | 60-70% | 2-3 weeks |

| Skills-First Hiring + Training | Entry to mid-level roles | 15-25% | 3-6 months |

| Automation + AI Tools | Reducing Tier 0 support needs | 30-50% capacity gain | 1-2 months |

| White-Label MSP Partnerships | Specialized services, compliance, security | 40-55% | 1-2 weeks |

Offshore Staffing: The Philippines Solution

The most transformative solution for Canadian MSPs has been strategic use of Philippines-based offshore staffing. As detailed in our comprehensive guide to why the Philippines dominates remote staffing, the Philippines offers unique advantages for Canadian businesses.

Deep IT talent pool: Over 1.82 million BPO professionals, many with specific MSP and helpdesk experience serving North American clients.

English proficiency and cultural alignment: As the world's third-largest English-speaking nation, Filipino professionals communicate clearly with Canadian clients. Decades of serving Canadian businesses have created strong cultural understanding and alignment with Canadian business practices.

Cost structure: 60-70% savings compared to Canadian domestic hiring for equivalent roles. A Level 1 helpdesk technician in Toronto costs $45,000-55,000 CAD fully loaded; the same role filled by a Philippines-based technician costs $15,000-22,000 USD.

Time zone considerations: While the Philippines is 12-13 hours ahead of Eastern Time, this creates natural after-hours coverage. Filipino teams working 8 AM-5 PM Manila time cover 7 PM-4 AM Toronto time—perfect for evening and overnight support without anyone working graveyard shifts.

Proven BPO infrastructure: Over 788 established BPO companies with experience serving Canadian businesses, mature security frameworks (ISO 27001, SOC 2), and established compliance with Canadian requirements including PIPEDA.

The cultural intelligence required to work effectively with Filipino professionals is straightforward, and remote onboarding practices have matured significantly.

Major Canadian companies—including banks like CIBC and National Bank of Canada, telecom giants like Bell Canada, and hundreds of smaller tech firms—already outsource to the Philippines. The model is proven, mature, and specifically designed for North American business requirements.

Skills-First Hiring with Rapid Upskilling

Rather than competing for scarce experienced talent, some Canadian businesses are shifting to skills-first hiring—focusing on aptitude, certifications, and demonstrated abilities rather than traditional degrees and years of experience.

This approach works particularly well for roles where company-specific knowledge matters more than general expertise. By hiring candidates with baseline technical competence and strong learning ability, then investing in intensive onboarding, businesses can create the specific talent they need rather than competing for perfect-fit candidates who don't exist.

Canadian businesses implementing skills-first hiring often partner with coding bootcamps like Lighthouse Labs or BrainStation, certification programs, or technical colleges to create pipelines of candidates who've demonstrated baseline competence.

Automation and AI-Powered Support

While AI is creating new role demands, it's also reducing the need for human involvement in certain tasks. Password resets, basic troubleshooting, system monitoring, and tier-0 support can increasingly be handled by automation and AI-powered tools.

As our analysis of how IT helpdesk services cut costs demonstrates, intelligent automation combined with strategic human support creates 30-50% capacity increases without adding headcount.

Canadian MSPs that implement AI-powered triage systems, automated ticket routing, and self-service knowledge bases can dramatically reduce the number of human technicians required while improving response times and consistency.

White-Label Partnerships and MSP Networks

Smaller Canadian MSPs facing capacity constraints are increasingly partnering with specialized providers for capabilities they can't staff internally. White-label NOC services, managed security operations, and specialized expertise (cloud, cybersecurity, compliance) allow MSPs to deliver comprehensive services without hiring full teams in every discipline.

According to recent MSP market analysis, white-label partnerships have emerged as the preferred solution for delivering 24/7 coverage and specialized services without building full in-house teams—particularly important given Canada's severe shortage in cybersecurity and cloud expertise.

The MSP-Specific Challenge in Canada

While all Canadian businesses face tech talent shortages, MSPs experience unique pressures that compound the problem.

The Breadth vs. Specialization Problem

MSP technicians need broad knowledge across multiple technologies—a generalist skill set that's increasingly rare as the industry trends toward specialization. Finding candidates who can troubleshoot Microsoft 365, AWS, on-premise servers, network issues, and security incidents while providing excellent customer service is extraordinarily difficult.

Yet the market rewards specialization. A candidate with deep AWS expertise can command $100,000+ as a cloud engineer. Why would they take an MSP generalist role at $65,000 that requires knowing Azure, GCP, networking, security, and more?

The Margin Compression Problem

Canadian MSPs operate on margins typically between 20-30% net profit. When domestic tech wages rise 25-35% for specialized skills, MSPs can't simply pass those costs to clients without losing accounts.

This creates a compensation ceiling that makes competing for talent economically unviable. As our MSP staffing crisis analysis details globally, many MSPs report they simply cannot afford market-rate compensation for the volume of staff they need.

The 24/7 Coverage Burden

Many MSP clients expect after-hours support, yet finding Canadian technicians willing to work nights or be regularly on-call has become nearly impossible. Companies struggle to fill daytime positions; overnight roles sit vacant indefinitely.

Traditional solutions—on-call rotations or dedicated night shifts—accelerate burnout and turnover. As our guide to delivering 24/7 support without burnout explains, these approaches are operationally unsustainable.

This is where offshore teams create transformative value. Philippines-based technicians working normal daytime hours in Manila (8 AM-5 PM) provide coverage during Canadian evening and overnight hours (7 PM-4 AM Eastern), all without anyone working graveyard shifts.

The Training Investment Paradox

Canadian MSPs invest heavily in training new hires (3-6 months to full productivity), only to watch them leave for higher-paying enterprise roles once they've gained experience. With 42% of IT professionals actively job hunting, this vicious cycle—invest in training, lose trained staff, repeat—makes traditional hiring economically unsustainable.

Offshore teams show dramatically better retention. Philippines-based professionals value long-term employment with international companies, viewing MSP roles as stable careers rather than stepping stones. Average tenure for Philippines-based MSP technicians is 3-5 years versus 18-24 months for Canadian helpdesk staff.

What to Expect Through 2026 and Beyond

Several trends will shape Canada's tech talent landscape over the next several years.

Continued Demand Growth Despite Economic Uncertainty

The Conference Board of Canada projects 305,000 additional tech workers needed between 2023-2028. Even if economic headwinds slow hiring in some sectors, the fundamental gap between supply (25,000-30,000 graduates annually) and demand (60,000+ needed) will persist.

AI, cloud transformation, cybersecurity, and digital transformation initiatives aren't optional—they're survival requirements. Demand may fluctuate year-to-year but the long-term trajectory remains upward.

Immigration Policy Will Remain Important But Insufficient

Canada will continue using immigration to partially address tech talent gaps, but it cannot be the primary solution. Global competition for immigrant tech talent has intensified, processing times have lengthened, and domestic political pressures create uncertainty about future targets.

Smart Canadian businesses plan based on the assumption that immigration will help but won't solve the problem entirely.

Offshore Solutions Will Continue Maturing

As our analysis of outsourcing plus AI explores, the combination of offshore teams and AI tools is becoming increasingly sophisticated. Canadian companies that embrace these hybrid models gain significant competitive advantages.

The performance gap between well-managed offshore teams and domestic teams continues narrowing as BPO providers invest in training, security certifications, and MSP-specific expertise. Within 2-3 years, operational differences will be minimal—while cost differentials remain substantial at 60-70% savings.

Greater Acceptance of Distributed Teams

The pandemic normalized remote work, and that shift appears permanent. For Canadian businesses, this means geography is less relevant for many roles. The question shifts from "where can we hire?" to "how can we build the most effective team regardless of location?"

MSPs that embrace this reality—using offshore teams strategically, implementing strong remote management practices, and focusing on outcomes rather than location—will thrive. Those clinging to traditional local-only hiring will face increasing competitive disadvantage.

Taking Action: A Framework for Canadian Businesses

If you're facing tech talent challenges, here's a strategic approach.

Step 1: Quantify Your Actual Need and True Costs

Calculate what unfilled positions cost you in lost revenue, overtime burden on existing staff, client dissatisfaction from slow response times, and opportunity cost of business you can't take on.

Often, when Canadian businesses calculate true costs, offshore staffing at $15,000-22,000 USD per technician becomes dramatically more attractive than leaving positions unfilled or paying $65,000-85,000 CAD domestically.

Step 2: Evaluate All Options Objectively

Consider offshore staffing for operational roles, automation to reduce headcount needs, white-label partnerships for specialized services, skills-first hiring plus intensive training, and strategic use of contractors for project work.

Most successful Canadian businesses use a hybrid approach rather than relying on a single solution.

Step 3: Pilot Before Scaling

Don't bet your entire operation on an untested approach. Start with one Philippines-based technician handling after-hours tickets for 2-3 friendly clients, measure results over 60-90 days, refine processes based on learnings, and scale what works.

This incremental approach minimizes risk while building confidence in the model.

Step 4: Build for Long-Term Sustainability

The talent shortage isn't temporary. Solutions that work for six months but aren't sustainable long-term just delay the problem. Focus on building models that can scale as your business grows and that don't depend on constantly winning recruiting battles in impossible markets.

The Bottom Line: Adaptation Is Essential

Canada's tech talent shortage in 2025 is not a temporary disruption that will self-correct. It's a structural shift driven by fundamental supply and demand imbalances that will persist for years.

The data is clear: 88% of Canadian tech leaders struggle to find talent. Canada needs 250,000 additional tech workers by year's end, with only 25,000-30,000 graduates annually. Tech unemployment at 3.3% means you're competing for employed workers, not hiring from available pools. Specialized skills command 25-35% premiums that most businesses cannot sustain.

Canadian businesses waiting for the market to normalize, hoping immigration policy will solve everything, or betting that salary increases alone will fix the problem are going to find themselves progressively less competitive against organizations that embrace alternative staffing models.

The MSPs, IT departments, and businesses that thrive through 2026 and beyond won't be those who solved the talent shortage through traditional hiring—because that's largely unsolvable. They'll be the ones who adapted their operational models to succeed despite it.

Offshore staffing, automation, skills-first hiring, and strategic partnerships aren't temporary workarounds. They're the new permanent reality of how sophisticated Canadian organizations build technical capacity in a talent-constrained world.

The question isn't whether to adapt—it's how quickly you can implement solutions before competitors gain advantages that become impossible to overcome.

Ready to Solve Your Canadian Tech Staffing Challenges?

Konnect specializes in connecting Canadian businesses and MSPs with dedicated IT professionals from the Philippines who integrate seamlessly into your operations—providing the technical capacity you need at sustainable cost structures.

What we provide:

Pre-vetted IT professionals with Canadian business experience: Our team members understand Canadian business culture, communication styles, and compliance requirements including PIPEDA. They're trained on common MSP platforms (ConnectWise, Autotask, Datto) and ready to integrate with your operations.

Follow-the-sun coverage optimization: We structure Philippine team schedules specifically for Canadian after-hours coverage (evenings and overnight), ensuring someone is always alert and available while working healthy daytime shifts in Manila.

Rapid deployment: Unlike 60-90 day domestic recruitment cycles, we deploy qualified technicians in 2-3 weeks, allowing you to address immediate staffing needs without months of waiting.

Flexible engagement models: Whether you need one helpdesk technician, an entire NOC team, or after-hours coverage specialists, we scale precisely to your requirements without long-term commitments.

Complete infrastructure and HR management: We handle Philippine employment law, payroll, benefits, facilities, and all administrative overhead so you focus on service delivery.

60-70% cost savings: Access skilled IT professionals at $15,000-$22,000 USD annually compared to $45,000-$55,000 CAD for equivalent domestic roles, with no compromise on quality.

Schedule a consultation to discuss how offshore staffing can solve your tech talent challenges sustainably.

📅 Schedule a meeting: https://meet.brevo.com/konnectph

✉️ Email us: hello@konnect.ph

Let's talk about building technical capacity that scales with your business at sustainable cost structures—without the endless recruitment battles.

About the Author

Vilbert Fermin is the founder of Konnect, a remote staffing company connecting North American and Australian businesses with top Filipino talent. With deep expertise in IT support and remote team management, Vilbert helps MSPs access skilled technical professionals without the overhead of full-time domestic IT staff. His mission is to showcase Filipino excellence while helping businesses stay protected, productive, and competitive through strategic remote staffing.